The crypto market has a way of revealing contrasts. On one side, Ethereum sits at record highs, yet its revenues have fallen sharply, raising uncomfortable questions about sustainability. On the other hand, a new meme coin sensation, Layer Brett, is rewriting the meme coin script, pulling in millions during its presale with staking rewards that traditional finance would call impossible.

This collision of fading fundamentals and rising momentum frames today’s discussion, where Ethereum price prediction collides with investor appetite for the next big thing.

Ethereum Price Prediction: Ethereum Revenue Drop, But Analysts Predict Bullish Leg Up

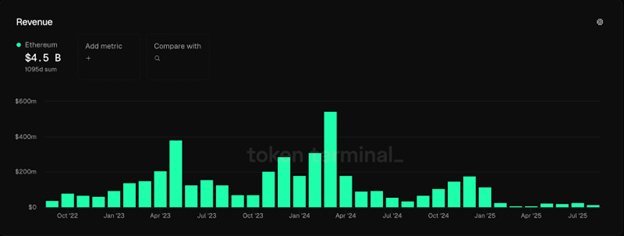

Ethereum is starting to feel the strain. Network revenue plunged about 44% in August, falling to $14 million despite the ETH price storming to record highs near $4,957. Fee income followed suit, down roughly 20% from July’s $49.6 million to $39.7 million, mainly because the Dencun upgrade spread transactions to cheaper Layer-2s.

Ethereum revenue. Source: Token Terminal

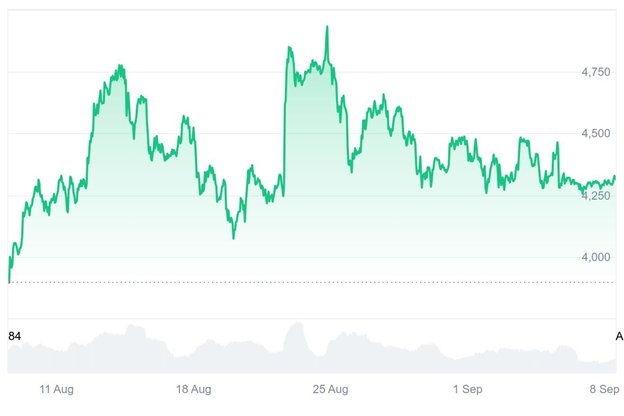

That drop has ratcheted up the fog around Ethereum price prediction. With shrinking fee flows, some analysts wonder whether underlying fundamentals are buckling. For traders, the price narrative is mixed. ETH recently bounced off a defensible zone between $3,800–$4,000, a range that could set the stage for another run at resistance near $4,400. But the chart could unravel toward $3,600 if that foundation doesn't hold.

Ethereum price chart. Source: CoinMarketCap

Still, institutional confidence is building. Spot ETH ETFs and staking structures offer yield. At the same time, staking holds tens of millions of ETH in lock-ups, shrinking supply while delivering returns for holders. All of these shape a more stable Ethereum price prediction, with structure rather than spikes anticipated.

Layer Brett: Meme Energy with Real Headers

Now, let’s talk about Layer Brett—a project capturing attention for building from cultural roots with structural strength. It's priced around $0.0055 in presale and has already pulled in over $3 million, signaling intense early demand. At its core, Layer Brett rests on Ethereum’s Layer-2 rails, combining meme branding with low-cost, fast transactions.

Staking is baked in, too. APY exceeds 830% for early participants, making it an excellent income stream that rewards patience. Tokenomics reinforce scarcity. There’s a tight 10 billion token cap, burn mechanics slice supply with usage, and presale pricing schemes reward earliest adopters. Roadmap features like NFT drops, gamified rewards, cross-chain bridges, and DAO governance create pathways beyond hype.

Where Ethereum trades on expectation shaped by infrastructure, Layer Brett trades on possibility shaped by design. It’s meme pedigree wrapped in clever mechanics—rare and magnetic.

Conclusion

Today's Ethereum price prediction story is grounded: revenue dips cloud the short term, but institutional traction and fee evolution suggest long-term stability. ETH remains the global DeFi hub, built on real demand rather than speculative narratives. Layer Brett represents the opposite side: a memecoin rewriting the playbook by pairing community with utility.

High staking yields, strong token fundamentals, and well-planned infrastructure set it apart. That's why its ongoing presale is dubbed one of the most promising projects of the year, with over 8,000 holders already in. Price is still at just $0.0055, and demand continues to skyrocket.

Layer Brett is still in presale, but it won’t be forever. Get in now before prices rise and rewards drop.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X